Interview

国富弹性市值股票基金经理张晓东- 切换到中文版 »

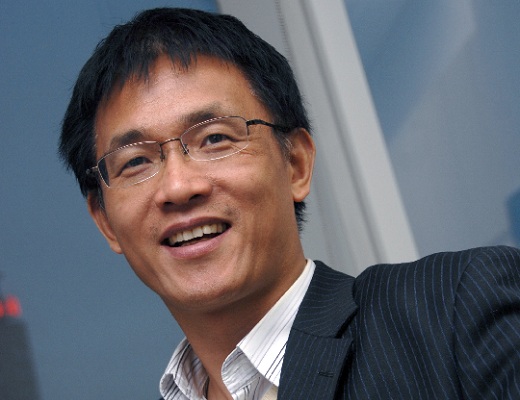

- Interview with Tony Zhang from Franklin Templeton Sealand Fund Management, Winner of Morningstar's 2013 China Equity fund of the Year Award

Interviewer: Rachel Wang

Morningstar (China) Research Center

Interviewee: Tony Zhang

Fund Manager of Franklin Templeton Sealand Flexicap Fund - Rachel: Congratulations on winning the Morningstar 2013 Equity Fund Award. As we know, you, your team and the funds you’ve been managing have been nominated by Morningstar many times in the past. You also had your first encounter with Morningstar many years ago, but it was not until 17 years later that you finally won the Morningstar fund award in 2013 by managing Franklin Templeton Sealand Flexicap Fund (“Flexicap”). Your personal story and experiences are seemed by many as very unique, intriguing and inspiring. What do you think about the Morningstar award and what are your feelings after winning the award?

Tony: In 1996, I was an analyst at San Francisco-based Asia equity boutique shop Newport Pacific Management. Mr. John (Jack) Mussey, the chairman of the firm, received the Manager of the Year award in the US. It was the first time Morningstar gave award to portfolio manager of international equities in the US.

Jack is the person I highly respect for integrity, foresight and investment discipline. Through his winning I came to know Morningstar award to be the highest honor for mutual fund managers worldwide for its rigorous standards like Oscar award for movie industry. Then I told myself I should do my best to get the award in my lifetime. Now the dream of 17 years comes true and I feel very happy.

I am very grateful to those who have helped me along the way: American couple Rochelle and Steve Wilson who introduced me to Jack Mussey for internship, Jack Mussey who inspired my dream as my role model, Franklin Templeton especially Stephen Dover and his deputies, who trains me in investment process, Sealand Securities’ chairwoman Madame Zhang Yafeng who has been very considerate to me, my colleagues at Franklin Templeton Sealand who support me with investment ideas. Last but not the least, my wife Vida who has been encouraging me never give up when I was at my career low points.

Rachel: Could you tell us about your investment philosophy and style, and how do you integrate your philosophy into your portfolio?

Tony: My investment combines top-down and bottom-up approaches but is more bottom-up driven. Stock selection forms sector allocation which in turn affects equity allocation. And I use top-down approach to adjust equity and sector allocation. I invest in companies and not stocks and would like to research a company thoroughly before investing. Apart from occasional arbitrage opportunities in distressed businesses, I buy companies for long-term sustainable earning growth.

I choose to stay with a company as long as it retains core competency, located in its growth phase of life cycle and its valuation is cheap or reasonable. I closely examine a company’s intangibles that make important barriers of entry, such as corporate culture encouraging innovation, brand recognition bringing pricing power and key persons’ leadership.

Strategic positioning is related to a company’s long-term viability. I pay close attention to what a company does and does not. My portfolios usually concentrate in no more than six sectors where I have gained in-depth industry knowledge. Stock holdings are usually no more than 35, with top 10 holdings accounting for half of portfolio NAV.

I try to understand how a company operates on a daily basis and how it invests for future growth. Favored companies are those strong or improving in fundamentals including capable or improving management. My daily job is to identify companies that meet my criteria in business fundamentals and leadership, then wait for buying opportunities or right price (discount to fair market value) to appear.

Rachel: Could you explain how do you control portfolio risk and how do you think about the “timing ability” in investing?

Tony: I am a contrarian or “buy low and sell high”. I try to find expectation gap between market consensus and reality to see whether the market is overly bullish or bearish toward a company or sector. Consequently, I decrease or increase weightings in relevant company or sector.

Very occasionally, I change my portfolio equity exposure sharply, significantly deviating from my peers, by as wide as 25 percentage points, to avoid sharp market downturn.

For example, in May 2008 when the US financial crisis surfaced, investors in China were in general complacent, thinking that China’s real economy was largely insulated from the spreading financial crisis. However, I believed then that lower housing prices would negatively impact US consumers and reduce demand for exports from China. Therefore, overcapacity would arise and hurt profitability of exports sector, and furthermore, cause collateral damages to China’s domestic companies that produce similar or complementary line of products to the exports. Eventually, the negatives would spread to larger part of the Chinese economy.

I reduced Flexicap’s equity exposure from 90% to 65% in about one month beginning in May that year and held the exposure till the year end.

As time went by, the negative impact of US housing bubble burst was more apparent and more negative news were reported on Chinese companies.

Due to much lower equity exposure, Flexicap significantly outperformed the market index (Shanghai & Shenzhen 300 Stock Index) by 22 percentage points in 2008.

However, opportunities for timing are very rare and one has to be very careful. My investment performance is mainly attributable to stock selection and sector allocation.

Rachel: You have managed Flexicap for nearly 7 years and many fund managers in China do not stay as long with a fund they manage. Please share with us what has been the biggest motivation for you to stay with the fund, and with the fund company for all these years.

Tony: Mutual fund industry in China is young and it began in 1998 or 15 years ago. It still has a lot of room to grow. Theme investing and quick buying in and out are more popular in China, as compared to value investing that requires patience.

Value investing has proven to be very rewarding in other markets and I believe it would work in China too and I stick to it. Investors’ investment needs are long-term, whether for their own retirement or their children’s education funding. I want to create a fund with satisfactory, sustainable, risk-adjusted returns, and promote value investing in China’s mutual fund industry.

The Franklin Templeton joint venture I work for allows me to grow as a person as well as a portfolio manager. So I choose to stay.

Rachel: What do you think of the current investment environment and opportunities in China? And from the perspectives of oversea investors, what do you think some of the opportunities and challenges are in investing in China?

Tony: Investment environment in China is promising but also challenging. The economy is transforming from export and investment driven to be more consumption driven. As exports and investment slow down, China’s GDP is slowing to 7% p.a., down from averaging 9-10% in the past decade. History in other economies tells us the transition is hard.

Aggressive investment stimulus in response to 2008 US financial crisis has pushed up land price and labor cost which reduce corporate margin. Housing prices are too high for families of average income. It’s tough to pick stocks in traditional manufacturing or housing-related sectors which contributed the high growth over the past decade.

However, as the rapid industrialization in China has brought about serious environmental damages and the government is determined to deal with them, there are good opportunities in water, air and waste treatment.

Besides, population aging (mainly due to one-child policy), broader and deeper health care coverage by the government, and spread of chronic diseases have all contributed to fast expansion of health care industry in recent years and the trend will likely to continue.

As the economy slows down, industrial overcapacity has surfaced in industrial commodities like cement, steel and coal, industry consolidations in those sectors will produce new winners and losers. More efficient producers will gradually emerge to become industry leaders.

Sectors mentioned above provide investment opportunities for the coming years in China.

投资策略论坛

它可持续的增长是20%是可以看得到的,最主要的原因是来自政府的投入,增加了投入这里面有更多的人,政府的投入是原来没有实现的需求,不可能支付的需求变得可行了,农村有很多人。

大部分的上市公司所有人确实是因为多低的股价,很少会有回购。最近一段时间稍微好一些,比如说宝钢也开始回购一些,但是整体上看我们股市的历史,这方面的回购应该是非常非常少有发生的。

我们中国经济现在处在什么样的地方?在未来也可能哪些地方可能会发生哪些变化。再来看一下我们的资本市场现在处在什么地方?再看一下未来可能会有几个可能变化的趋势,再提出我们的策略。

我们认为支撑债券,是信用底系不会产生崩溃,是因为信用主体它偿债的能力,我们看到很多同行,他觉得中国经济花了很多钱,它的杠杆率是比较高的,企业经营的比较困难...

关于价值的理解有多种方式,重置成本低估,产业并购价值,高分红率,我们注重安全边际的成长性投资,所以我们一直在这两点平衡。怎么控制风险,有的人是通过控制仓位,有的人是交易频繁。

从宏观数据来讲从近期的反馈调研来看,今年整体是呈现温和复苏的态势,是从宏观经济增长的态势来看。从价格体系来看,经济温和复苏的背景下面,全年的价格体系呈现一个温和上涨的态势。